For personal service - 1-800-738-2265

24 hr voice response - 1-800-520-2265

Open a New Account OnlineFor personal service - 1-800-738-2265

24 hr voice response - 1-800-520-2265

Open a New Account Online

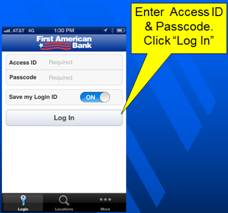

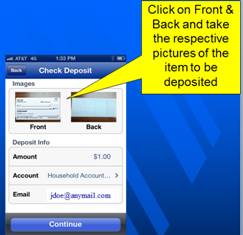

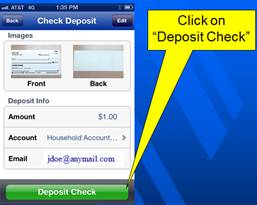

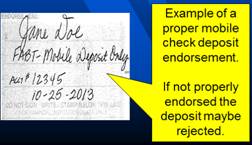

Mobile Check Deposit allows you to deposit checks quickly and easily from a smartphone (iPhone® and Android) into a deposit account at First American Bank, by endorsing, photographing and transmitting the check to the bank.

The number one benefit is convenience. Mobile Check Deposit allows you to deposit a check(s) 24 hours a day, 7 days a week.

No. There is no fee for using the Mobile Check Deposit to deposit your checks into a First American Bank checking or savings account. Note: Your mobile carrier's web charges may apply.

To download the First American Bank and Trust app – Visit the App Store or Google Play store on your smartphone. Search for "First American Bank and Trust" and download it. Icon should look like the one below:

*Most Common Errors:

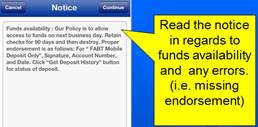

Checks may be deposited at any time, however, in order to be processed on the same business day, the deposit must be submitted by 4:30 p.m. Central Standard Time.

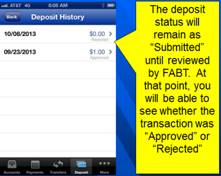

For each deposit, a deposit receipt notification from monitor@ensenta.com can be sent to your email address.

On a normal business day, deposits must be received by 4:30 P.M. CST to receive same day processing. Funds will normally be available on the next business day. However, FABT reserves the right to place a hold on any item deposited VIA Mobile Deposit, if it does so, your funds will not be available on the next business day.

You should write the words "MOBILE DEPOSITED ON (date)" across the front of the check, store it in a secure location for 90 days, and then shred it or otherwise securely destroy it.

An image of the check goes to the bank, and we begin the normal process of collecting the money from the checks maker.

At First American Bank our goal is to protect the integrity of your account. While we make every effort to safeguard your information, there are steps you should take to protect yourself and your account:

Please contact us at (800) 738-2265 or visit a First American Bank branch location near you.

Contact us with any questions you may have. Send us an email and we will get back to you as soon as possible with the answers you need.

Contact Us